Which best describes the net present value method of investment appraisal?

Select ONE answer:

- The profit from an investment equal to the initial outlay

- The amount of the discounted return on an investment

- The amount of the discounted value of inflows from an investment

- The investment required to produce a positive return on an investment

- The rate to produce a positive return on a proposed investment

What are the advantages and disadvantages of the NPV method?

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This is multiple choice question is suitable for Accounting KS5 classes.

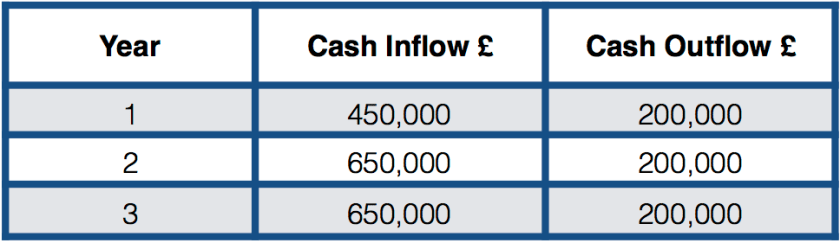

The answer is 2 – Net present value (NPV) is determined by calculating the costs (negative cash flows) and benefits (positive cash flows) for each period of an investment. After the cash flow for each period is calculated, the present value (PV) of each one is achieved by discounting its future value at a periodic rate of return (the rate of return dictated by the market). NPV is the sum of all the discounted future cash flows. Because of its simplicity, NPV is a useful tool to determine whether a project or investment will result in a net profit or a loss. A positive NPV results in profit, while a negative NPV results in a loss. The NPV measures the excess or shortfall of cash flows, in present value terms, above the cost of funds. In a theoretical situation of unlimited capital budgeting, a company should pursue every investment with a positive NPV.

This work is licensed under a Creative Commons Attribution 4.0 International License.

You must be logged in to post a comment.