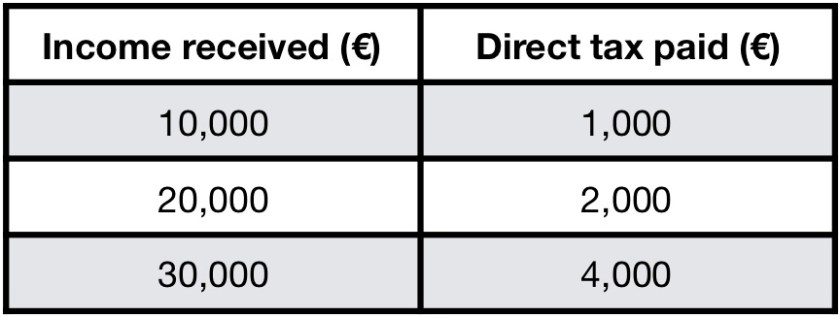

The table shows the amount of direct tax paid by individuals at different levels of income in a country in the eurozone.

Which of the following statements about the country’s direct tax system is true?

Select ONE answer:

- The system is progressive throughout the income range

- The system is proportional from €10 000 to €20 000 only

- The system is proportional throughout the income range

- The system is regressive from between €20 000 and €30 000

Show your workings to arrive at your answer, and explain and justify your reasons:……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This multiple choice question is suitable for Economics KS5 classes.

The answer is 2

- Tax does indeed rise as income rises but this does not define a progressive system.

- Correct: The proportion of income taxed remains at ten percent.

- It is indeed proportional in the 10–20,000 range but not thereafter.

- Regressive means a lower proportion of tax as income rises. Here it is higher.

This work is licensed under a Creative Commons Attribution 4.0 International License.