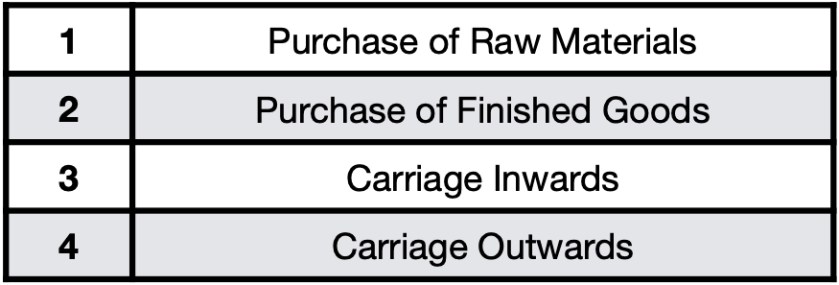

The following items appear in the accounts of a manufacturing business.

Which items will be included in the Manufacturing account?

Select ONE answer:

- 1 and 2

- 1 and 3

- 1,2 and 3

- 1,3 and 4

Show your workings to arrive at your answer, and explain and justify your reasons:

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This multiple-choice question is suitable for Accounting KS5 classes.

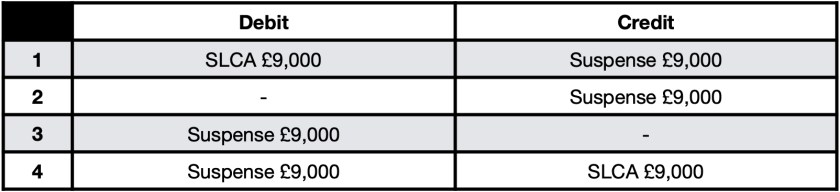

The answer is 2

- Not correct

- Correct – £60,000 +£7,200 + £47,300

- Not correct

- Not correct

This work is licensed under a Creative Commons Attribution 4.0 International License.

You must be logged in to post a comment.