Y Ltd purchases the business of J Brown by issuing £1 shares at a premium of £0.20.

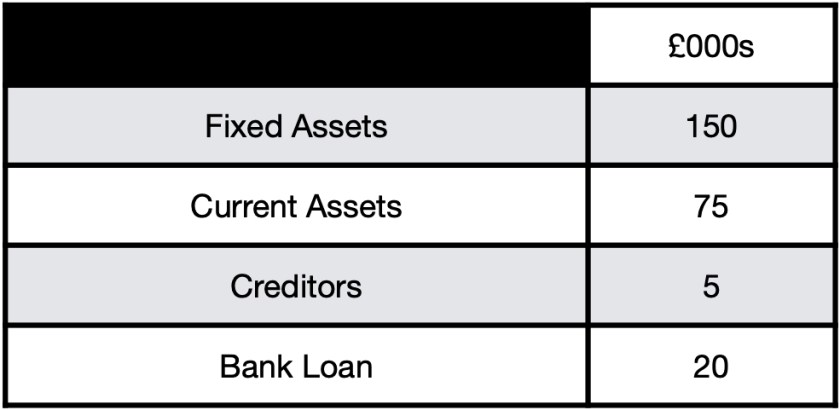

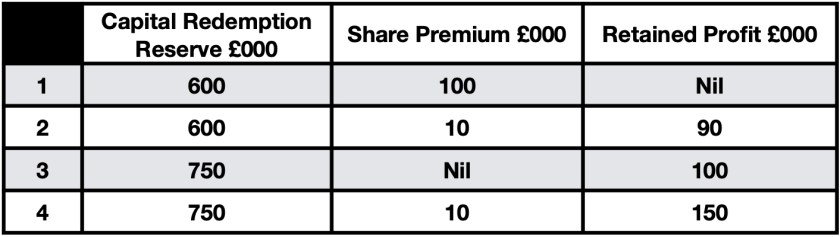

Y Ltd agrees to take over J Brown’s assets and liabilities at the date of the acquisition as follows.

Goodwill is valued at £10,000.

How many shares will J Brown receive from Y Ltd?

Select ONE answer:

- 158,000

- 175,000

- 200,000

- 210,000

Show your workings to arrive at your answer, and explain and justify your reasons:

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

This multiple-choice question is suitable for Accounting KS5 classes.

The answer is 2

- Not correct

- Correct – (£150k + £75k – £5K – £20k + £10k) ==> £210k / £1.20

- Not correct

- Not correct

This work is licensed under a Creative Commons Attribution 4.0 International License.

You must be logged in to post a comment.